First Time Home Buyer Tips

First time home buyer tips to ensure that buying your first home is an exciting and rewarding milestone. And while buying your first home is exciting, it can also be a daunting experience with so many factors to consider. THINKING ABOUT BUYING A HOME? ASK YOURSELF THESE QUESTIONS.

Whether you’re a first-time home buyer or just looking for a refresher, here are some tips to help make the process easier:

Determine your budget: Before you start house hunting, it’s essential to determine how much you can afford to spend on a house. Consider your income, monthly expenses, and how much you have saved for a down payment. And keep in mind that you might not need as much for a down payment as you might think.

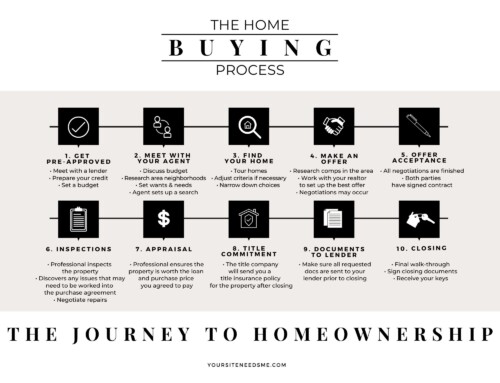

Determine your budget: Before you start house hunting, it’s essential to determine how much you can afford to spend on a house. Consider your income, monthly expenses, and how much you have saved for a down payment. And keep in mind that you might not need as much for a down payment as you might think. - Get pre-approved for a mortgage: A mortgage pre-approval gives you a better idea of what you can afford and helps speed up the home buying process. It also shows sellers that you’re a serious buyer.

- Work with a real estate agent: A real estate agent can help guide you through the home buying process and provide invaluable advice. They can help you find homes within your budget, negotiate with sellers, and handle the paperwork.

- Consider the location: Location is an essential factor when buying a home. Consider factors like commute times, internet services, access to public transportation, nearby schools, and community amenities and things to do.

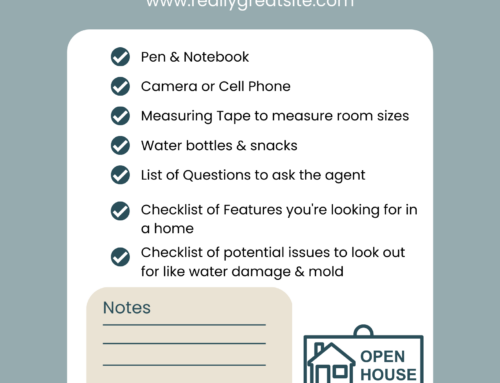

- Look beyond the surface: Don’t be swayed by a home’s aesthetics. Look beyond the surface and consider the home’s overall condition, including the roof, foundation, electrical and plumbing systems. The perfect home might just be the home you make perfect after you buy it!

- Get a home inspection: A home inspection is a crucial step in the home buying process. It can help identify any potential problems with the property and prevent you from making a costly mistake.

- Consider future expenses: In addition to your mortgage payment, consider future expenses like property taxes, homeowners’ insurance, and maintenance costs.

- Don’t rush the process: Buying a home is a significant investment, and it’s important not to rush the process. Take your time, do your research, and only make an offer on a property when you’re confident it’s the right fit. And keep in mind, your first home does NOT have to be your forever home.

FREE HOME BUYER GUIDE: THINGS TO CONSIDER WHEN BUYING A HOME

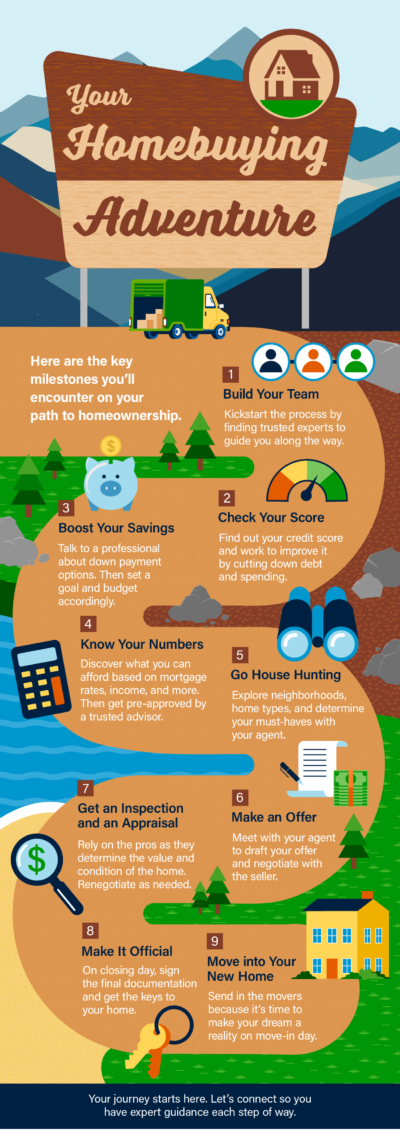

YOUR HOME BUYING ADVENTURE: INFOGRAPHIC

Buying your first home is an exciting but complicated process. By following these first time home buyer tips, you can help ensure a smooth and successful home buying experience.

As local market experts in the Greater Charlotte region, we have the knowledge, experience, and networks to help you achieve your homeownership goals, whatever they may be. Reach out to me today for a free consultation and commit to keeping your resolution to buy a new home in the new year.

Nina Hollander with Coldwell Banker Realty has been opening doors for Greater Charlotte area home buyers for 25+ years. I’d love an opportunity to earn your business, to exceed your expectations, and to show you why experience matters and how:

“The Right Broker Makes All The Difference.”