U.S. Housing Market Outlook Mid-2025: Trends, Prices, Inventory

U.S. Housing Market Outlook Mid-2025: Trends, Prices, and Strategic Advice for Buyers and Sellers

As we pass the midpoint of 2025, the U.S. housing market outlook for mid-2025 reveals a pivotal shift. The post-pandemic real estate frenzy has faded, giving way to a more measured, transitional phase. With elevated mortgage rates, cautious consumer behavior, and rising housing inventory levels, the market is redefining what it means to buy or sell a home today.

“The housing market is at a turning point,” says Nadia Evangelou, Senior Economist at the National Association of Realtors.

“The housing market is at a turning point,” says Nadia Evangelou, Senior Economist at the National Association of Realtors.

This evolving landscape presents both challenges and opportunities—and understanding the U.S. housing market outlook for mid-2025 is critical for making informed real estate decisions.

In this comprehensive U.S. housing market outlook for mid-2025, we break down four key factors shaping the current market and offer expert strategies for navigating them—whether you’re buying, selling, or just tracking real estate trends.

1. Home Sales Remain Below Pre-Pandemic Levels—But Momentum is Building

Existing home sales are seeing slight improvements over 2024 figures, yet activity remains well below historical norms. Economic uncertainty, elevated home prices, and high mortgage rates continue to sideline many prospective buyers. “Home sales have been at 75% of pre-pandemic levels for the past three years,” says Lawrence Yun, Chief Economist for the National Association of Realtors.

Despite that, signs of renewed market momentum are emerging. Rising inventory levels and selective price reductions are drawing buyers back in. According to Realtor.com’s Hannah Jones, seasonal trends like increased listings and moderate price growth are expected—but activity may still feel muted.

What This Means for You:

-

Buyers: A slower pace and reduced competition may provide more negotiation power. It’s a great time to explore listings, especially if you’re prepared to act quickly.

-

Sellers: Offering incentives such as mortgage rate buydowns or closing cost assistance can make your home more appealing to budget-conscious buyers.

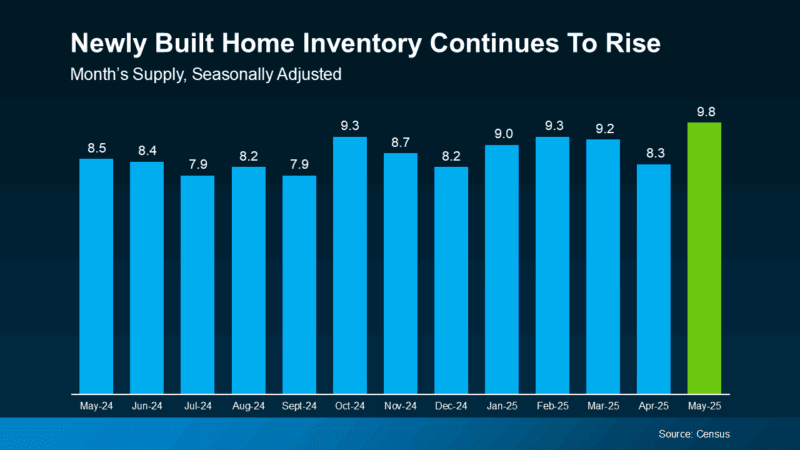

2. Housing Inventory Is Rising—Creating a Buyer’s Market in Many Areas

A major theme in the U.S. housing market outlook for mid-2025 is the significant increase in housing supply. Active listings are up by over 33% year-over-year, driven by homeowners choosing to sell despite market uncertainty.

Factors contributing to this rise include:

-

Cooling demand in previously hot markets due to the return-to-office trend

-

High interest rates pricing out many buyers

-

Sellers no longer waiting on the sidelines

In areas like the South and West Coast, buyers now hold more leverage. Homes are sitting on the market longer, and inventory is building up. “The balance of power has shifted toward buyers,” notes Redfin economist Asad Khan.

What This Means for You:

-

Buyers: More choices and more bargaining power. This is one of the best windows in recent years to enter the market strategically.

-

Sellers: To stand out, pricing competitively, staging professionally, and being open to negotiation are essential.

3. Home Prices Are Softening—But a Major Drop Is Unlikely

Another key highlight in the U.S. housing market outlook for mid-2025 is the softening of home prices. After years of dramatic appreciation, U.S. home prices are stabilizing. While some Northeast and Midwest markets are still seeing increases, values are flattening or declining across much of the country, particularly in the Sun Belt. Newsweek reports home values dropped in over half of U.S. states during early 2025, with a projected 1% national price dip by year-end.

The Truth About Where Home Prices Are Heading

Despite softening, a housing market crash is not expected. “The housing market isn’t crashing—it’s coming down from a sugar high,” says finance expert Michael Ryan. Affordability remains a concern: Households earning $75,000 now qualify for just 20% of available homes, compared to 50% pre-2020. Supply shortages are also preventing deeper price declines.

What This Means for You:

-

Buyers: Look for motivated sellers and price reductions. Some markets may offer great deals, especially on lingering listings.

-

Sellers: Be realistic. Strategic pricing based on today’s data—not 2021 highs—is crucial.

4. Mortgage Rates in 2025: High, but Stable

As of mid-2025, 30-year fixed mortgage rates remain just under 7%. Lawrence Yun forecasts an average of 6.4% in the second half of the year. While lower than earlier this year, rates remain significantly above the pandemic-era lows. “Affordability is still the top concern for buyers,” says Hannah Jones of Realtor.com.

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

In response, many builders and sellers are offering concessions like:

-

Mortgage rate buydowns

-

Closing cost credits

-

Flexible financing terms

Currently, there are more new construction homes to choose from. As a result, many builders are cutting their prices and offering additional incentives. Many are offering better mortgage rates too with mortgage rate buy-downs. According to the National Association of Home Builders, 37% of home builders reported cutting prices in June. This is the highest percentage since NAHB started tracking this metric on a monthly basis in 2022.

What This Means for You:

-

Buyers: Don’t wait for a dramatic drop in rates. Instead, focus on negotiating seller concessions and plan to refinance if rates fall later.

-

Sellers: Offering financial incentives can expand your buyer pool and lead to faster sales.

Your Local Housing Market Advantage Starts Here

While the U.S. housing market outlook for mid-2025 provides valuable national insight, real estate is hyper-local—and conditions can vary significantly by city, neighborhood, and even block.

Whether you’re buying, selling, or holding, success depends on understanding these nuances. If you’re a buyer, this market offers expanded inventory and negotiation leverage—but also demands a close eye on affordability. If you’re a seller, strategy matters more than ever.

And if you’re a homeowner, now might be the right time to explore refinancing, downsizing, or cashing in on home equity to make your next move.

Ready to Make a Smart Move in 2025?

The U.S. housing market outlook for mid-2025 is full of change—but also full of opportunity. As experienced local real estate professionals, we’re here to help you interpret the trends and act with confidence.

Contact us today to schedule a personalized market consultation and find out how current housing trends can work in your favor.